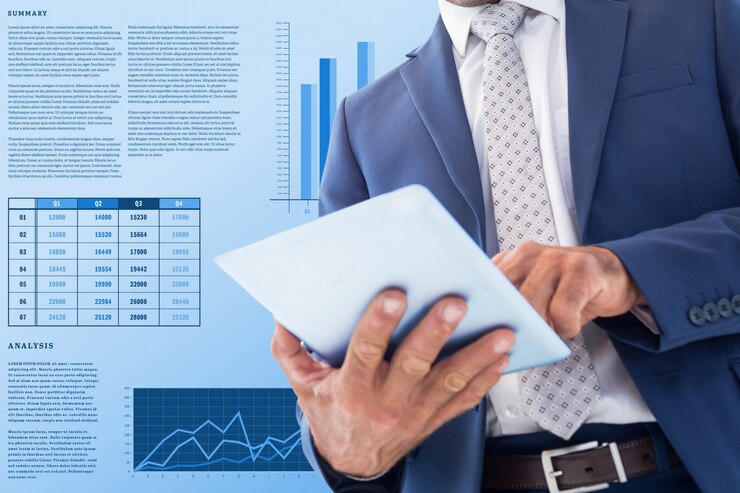

Introduction to Forensic Loan Reports

Forensic loan reports are essential tools in the financial industry, used to examine and analyze loan documents and borrower behavior. These reports provide detailed insights into loan transactions, uncovering irregularities and potential fraud. Financial institutions, auditors, and legal professionals rely on these reports to ensure the integrity of loan processes and protect against financial misconduct.

The Importance of Understanding Borrower Behavior

Understanding borrower behavior is crucial for lenders to assess risk and make informed lending decisions. Forensic loan reports help dissect borrower actions and motivations, offering a clearer picture of their financial practices. This understanding aids in identifying patterns of behavior that could indicate potential default, fraud, or other financial discrepancies.

Components of a Forensic Loan Report

A comprehensive forensic loan report includes several key components: loan application analysis, payment history, financial statements, and collateral evaluation. Each component is meticulously examined to ensure accuracy and identify any inconsistencies. By piecing together these elements, a forensic loan report provides a holistic view of the borrower’s financial situation.

Loan Application Analysis

The first step in a forensic loan report is the analysis of the loan application. This involves verifying the information provided by the borrower, such as income, employment history, and credit score. Any discrepancies or false information can be red flags for potential fraud. The accuracy of this initial data is critical in assessing the borrower’s true financial standing.

Payment History Examination

A detailed examination of the borrower’s payment history reveals patterns in their financial behavior. Forensic loan reports scrutinize payment consistency, delays, and defaults. This analysis helps identify borrowers who may be struggling financially or intentionally manipulating payment schedules to conceal financial difficulties.

Financial Statements Scrutiny

Analyzing the borrower’s financial statements provides deeper insights into their overall financial health. Forensic loan reports review balance sheets, income statements, and cash flow statements. This scrutiny helps detect discrepancies between reported income and actual financial performance, uncovering potential misrepresentations.

Collateral Evaluation

Collateral evaluation is another critical aspect of forensic loan reports. The value and legitimacy of collateral offered by the borrower are assessed to ensure it meets the loan requirements. This evaluation prevents overvaluation or fraudulent claims of collateral, protecting the lender’s interests.

Identifying Fraudulent Activities

Forensic loan reports play a pivotal role in identifying fraudulent activities. By examining inconsistencies in loan documentation, payment patterns, and financial statements, these reports can uncover attempts to deceive lenders. Common fraud indicators include inflated income, falsified employment information, and misrepresented collateral values.

Case Study: Detecting Mortgage Fraud

A notable case study involves detecting mortgage fraud through forensic loan reports. In this scenario, a borrower provided false income documentation and inflated property values to secure a larger loan. The forensic loan report revealed these discrepancies, leading to legal action and preventing significant financial loss for the lender.

The Role of Technology in Forensic Loan Analysis

Advancements in technology have significantly enhanced forensic loan analysis. Automated tools and software can quickly process and analyze vast amounts of data, improving the accuracy and efficiency of forensic loan reports. These technologies also help in identifying complex patterns and anomalies that may be missed through manual analysis.

The Impact of Regulatory Compliance

Regulatory compliance is a critical aspect of forensic loan reports. Financial institutions must adhere to strict regulatory standards to prevent fraud and ensure transparency. Forensic loan reports help ensure compliance by thoroughly examining loan documents and borrower behavior, reducing the risk of regulatory violations.

Training and Expertise in Forensic Loan Analysis

The effectiveness of forensic loan reports depends on the expertise of the professionals conducting the analysis. Specialized training in forensic accounting, fraud detection, and loan analysis is essential. Skilled analysts can identify subtle indicators of fraud and provide accurate assessments of borrower behavior.

Challenges in Forensic Loan Reporting

Despite their importance, forensic loan reports face several challenges. Complex loan structures, incomplete documentation, and sophisticated fraud schemes can complicate the analysis process. Continuous advancements in fraud tactics require forensic analysts to stay updated with the latest techniques and tools.

Future Trends in Forensic Loan Analysis

The future of forensic loan analysis will likely see increased integration of artificial intelligence and machine learning. These technologies can enhance the accuracy and speed of forensic loan reports, providing deeper insights into borrower behavior. Additionally, blockchain technology may offer new ways to ensure the integrity of loan documentation.

Ethical Considerations in Forensic Loan Reporting

Ethical considerations play a significant role in forensic loan reporting. Analysts must maintain objectivity and confidentiality throughout the analysis process. Ensuring the ethical use of forensic loan reports protects the rights of borrowers while maintaining the integrity of the financial system.

Collaboration Between Financial Institutions and Forensic Analysts

Collaboration between financial institutions and forensic analysts is essential for effective loan analysis. Lenders must provide accurate and complete documentation, while analysts offer their expertise in examining and interpreting the data. This partnership helps identify potential risks and enhances the overall quality of loan portfolios.

The Economic Impact of Forensic Loan Reports

Forensic loan reports have a significant economic impact by preventing financial losses and promoting transparency in the lending process. By identifying fraudulent activities and ensuring regulatory compliance, these reports contribute to the stability and integrity of the financial system. Lenders can make more informed decisions, reducing the risk of default and financial crises.

Examining Loan Application Integrity

Loan application integrity is the cornerstone of any forensic loan report. By scrutinizing the initial data provided by borrowers, analysts can verify the accuracy of information such as income, employment history, and credit score. Any discrepancies or false information uncovered during this process can serve as early indicators of potential fraud, guiding further investigative efforts and protecting lenders from deceptive practices.

The thorough analysis of loan applications involves cross-referencing the provided data with independent sources. This step ensures that the information is not only accurate but also consistent with external records. By confirming the legitimacy of the borrower’s claims, forensic loan reports establish a reliable foundation for assessing the borrower’s true financial standing and future risk.

Uncovering Payment Patterns

Payment patterns provide critical insights into a borrower’s financial behavior and stability. Forensic loan reports meticulously examine the borrower’s payment history to identify consistency, delays, and defaults. This analysis helps to highlight patterns that may indicate financial distress or deliberate manipulation of payment schedules, both of which can signal underlying issues that need to be addressed.

By analyzing payment trends, forensic loan reports can also detect subtle signs of financial mismanagement. For example, frequent late payments or irregular payment amounts might suggest that a borrower is struggling to maintain their financial obligations. Understanding these patterns allows lenders to proactively address potential problems, ensuring that borrowers receive the necessary support to avoid default.

Analyzing Financial Statements

Financial statements are a treasure trove of information for forensic loan analysts. By examining balance sheets, income statements, and cash flow statements, analysts can gain a comprehensive view of the borrower’s financial health. This scrutiny helps detect discrepancies between reported income and actual financial performance, which can be critical in uncovering potential misrepresentations or fraudulent activities.

In addition to identifying inconsistencies, analyzing financial statements provides insights into the borrower’s overall financial strategy and stability. Trends in revenue, expenses, and cash flow can reveal whether the borrower is experiencing growth or facing financial challenges. This information is crucial for lenders to make informed decisions about the borrower’s creditworthiness and the potential risks associated with extending additional credit.

Conclusion: The Value of Forensic Loan Reports

Forensic loan reports are invaluable tools for understanding borrower behavior and ensuring the integrity of loan transactions. By providing detailed insights into loan applications, payment histories, financial statements, and collateral evaluations, these reports help identify potential fraud and mitigate financial risks. As technology continues to advance, the effectiveness of forensic loan analysis will only improve, further safeguarding the financial industry.